All Categories

Featured

Table of Contents

- – Medicare Providers Near Me Laguna Beach, CA

- – Harmony SoCal Insurance Services

- – Senior Health Insurance Laguna Beach, CA

- – Seniors Insurance Laguna Beach, CA

- – Senior Dental Insurance Laguna Beach, CA

- – Reasonable Dental Insurance For Seniors Lagun...

- – Best Dental Insurance For Seniors Laguna Bea...

- – Best Senior Insurance Laguna Beach, CA

- – Dental Insurance For Seniors Laguna Beach, CA

- – Best Insurance For Seniors Laguna Beach, CA

- – Vision And Dental Insurance For Seniors Lagu...

- – Best Senior Insurance Laguna Beach, CA

- – Medicare Insurance Agent Near Me Laguna Beac...

- – Medicare Providers Near Me Laguna Beach, CA

- – Dental Insurance Seniors Laguna Beach, CA

- – Harmony SoCal Insurance Services

Medicare Providers Near Me Laguna Beach, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Nevertheless, actual protection details differ commonly from plan to strategy. Numerous Medicare Advantage strategies have very restricted oral benefits and regardless, it's approximated that around 65% of Medicare recipients had no dental protection. 4 Broadly speaking, there are two main kinds of oral coverage available for elders that are no longer qualified for oral advantages via work: If you are 65 or older, you may be eligible to register in a Medicare Benefit strategy that supplies some dental care benefits.

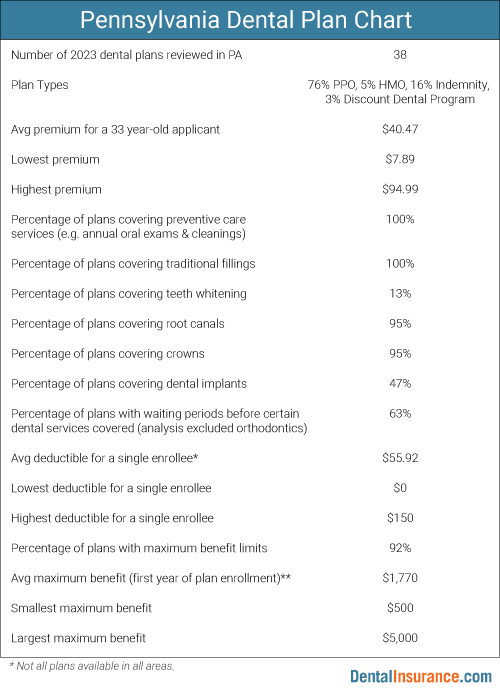

Find out a lot more regarding the different sorts of Medicare Benefit prepares here. Specific oral strategies for seniors are available from a range of personal dental insurance coverage companies. Oral plans tend to concentrate on making preventive treatment a lot more economical: Many strategies cover 100% of preventative treatment costs, according to the National Organization of Dental Plans.

Senior Health Insurance Laguna Beach, CA

PPOs often tend to have a multitude of dental experts "in network," however strategies differ, so inspect to see if a neighboring provider you like remains in the network before signing up. These network suppliers have pre-negotiated rate price cuts, with the insurance policy company that can assist you minimize all your dental care.

These oral plans have a tendency to supply lower costs and deductibles, however there's also much less versatility with a restricted network of service providers. 8 Like HMO health and wellness treatment plans, members select a Key Dental expert and need to go via that service provider for all their care, consisting of professional references. Numerous DHMO dental strategies have no deductibles or caps and while there might be a flat-rate copayment for non-preventive therapies, your overall expenses will likely be reduced.

It is very important to recognize the details of any type of strategies you are considering. A specific dental insurance policy plan will certainly cover routine oral care appointments, cleanings, and commonly x-rays at little or no expense to the plan holder. 9Depending on the details strategy, oral insurance can likewise cover more substantial dental job like easy extractions and dental caries fillings and even significant procedures like crowns and bridges.

Seniors Insurance Laguna Beach, CA

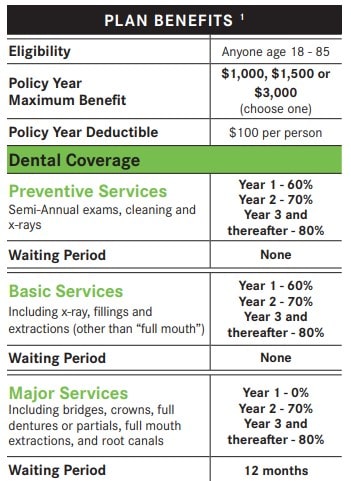

Plan deductible: Lots of strategies have a deductible. This is the amount you require to pay prior to the dental strategy begins paying. The bright side is that routine precautionary visits generally aren't based on the deductible, and when you have actually met the insurance deductible for any type of other treatment, you will not pay it again till it resets the list below year.

In some cases, it's a percentage of the cost: some strategies cover major treatment at 50% definition 50% of the costs will certainly be your responsibility. Yet remember: when you see a network PPO dental practitioner, that cost may have currently been discounted by regarding 30%, so at the end of the day, your out-of-pocket price might just be 35% of the complete "listing" cost.

Locating the best Medicare Benefit strategy for your requirements needs closely considering your spending plan, healthcare demands, and the plans available in your area. Medicare Benefit strategies are provided by private insurance firms that have gotten federal government approval. Not all Medicare Benefit intends offer seniors dental insurance protection. You may intend to think about a comprehensive strategy that covers extra intricate dental treatment, such as implants or dentures.

Comprehending how oral insurance policy for senior citizens jobs can assist you optimize benefits and stay clear of unanticipated costs. A fixed month-to-month price keeps your strategy active. Predictable settlements for assurance. Examinations, cleanings, and x-rays are typically covered 100%. Stops little issues from ending up being huge costs. Dental fillings, crowns, or dentures are partially covered.

Senior Dental Insurance Laguna Beach, CA

Each plan has an annual coverage limit. Makes certain the biggest financial savings on every go to. Use within 30 days of retirement to make certain constant insurance coverage and skip any type of waiting durations for your new oral strategy.

Best for elders that just need preventive solutions. Balanced plan covering preventative care plus restorative solutions like bridges and crowns. Ideal for senior citizens that want comprehensive protection at a modest premium. Expanded protection with a higher yearly advantage maximum and reduced out-of-pocket prices. Best for elders expecting significant oral work or requiring substantial solutions like dentures or implants.

Reasonable Dental Insurance For Seniors Laguna Beach, CA

Protection for treatments to deal with advanced oral problems., including options for seniors with varying requirements, whether you're looking for fundamental care or more extensive dental work.

Below are some methods to discover the very best oral insurance policy for seniors on Medicare. Initial Medicare does not cover dental health so you'll intend to take into consideration options for dental insurance coverage. Here are some suggestions to assist; Consider what oral service you need? Do you require dentures or implants? Are your teeth in fairly excellent or poor shape? Think about Medicare Advantage prepares with oral advantages.

Evaluation plan protection carefully. Review all limitations. Call companies advertising their products. Get a consultation from a regional insurance professional. Elders on Medicare have many options for oral coverage. 2 in 3 elders 65 and older have gum tissue illness according to the Centers for Illness Control and Avoidance (CDC).

Periodontal disease raises the risk of heart illness. Older adults with bad dental hygiene who smoke are at raised danger of bacterial pneumonia. They also face enhanced threat of oral cancers cells. While rare, some 54,000 situations or oral cancer cells are expected to be identified in the United States this year.

Best Dental Insurance For Seniors Laguna Beach, CA

Those who offer Medicare Supplement (Medigap) really commonly additionally use elderly oral plans. Dental insurance coverage within these strategies is typically consisted of (complimentary).

It is cost-free and totally personal. Just enter your zip code. Click the link to access the. The majority of people only focus on the clinical or health-related aspects of Medicare when they transform 65. That is easy to understand since choosing what's the very best health-plan option can be perplexing enough. Oral is a vital component and must at the very least be evaluated as an aspect when comparing alternatives.

And, these plans frequently advertise the fact that they consist of totally free added benefits. Oral is typically stated as one of the included benefits. What strategies cover and what limitations exist can differ.

Examine very carefully to see if your dentist is coverage by a specific dental strategy you are taking into consideration. He or she likely knows better than any person what oral insurance coverage for seniors strategies are best.

Best Senior Insurance Laguna Beach, CA

A representative normally represents simply one insurance policy business. A broker typically is independent and stands for multiple insurance coverage business. At least understand why they may be suggesting a specific insurance plan.

There are benefits and drawbacks for each strategy. Some insurance provider offer numerous plans to contrast. It pays to collaborate with somebody that can assist you compare strategies from these suppliers: Aetna Aflac Cigna Delta Dental Humana Renaissance Dental United Health Care Find Latest Discover Find out more concerning options.

Dental Insurance For Seniors Laguna Beach, CA

The business uses two oral plans, Common Dental Protection and Common Dental Preferred, as well as a vision motorcyclist and an oral savings plan. The least expensive oral plan starts at an approximated $29.27 each month, although costs will vary by place. You can pick from annual optimum benefits of as much as $5,000 to tailor the insurance coverage to your requirements.

Costs and biker costs differ, nevertheless, and strategies are not available in all 50 states. The Common Dental Protection plan sets you back about $29.27 per month with a $100 schedule year deductible.

The Common Dental Preferred plan sets you back regarding $56.38 monthly. It has no insurance deductible for preventive solutions, however there's a $50 deductible for standard and major solutions. Its preventive and major services coverage coincides as the Security strategy, yet the Preferred strategy covers 80% of fundamental services compared to the Defense plan's 50%.

Best Insurance For Seniors Laguna Beach, CA

You may have obtained away with routine oral examinations and cleanings in your younger years. Yet older grownups' teeth may need more complicated treatment. A dental plan that only covers you for preventative care will certainly not assist you pay for extra costly oral procedures and therapies if you require them.

Health and wellness concerns, nutrition, prescription medication use, and even your psychological and emotional health and wellness, can impact your oral wellness. Expect to need any of the following dental procedures? Discover out what degrees of oral protection you may need. In the oral plan records, they may be called "courses" of insurance coverage. Dental fillings and teeth removals may be covered as standard restorative care.

Once you fulfill your oral insurance deductible, that portion shows exactly how much of the expense your plan will certainly pay for these treatments. Look for these details procedures in the plan files.

Purchase a dental strategy that offers a percent of protection. As soon as you satisfy your deductible, the percent is the quantity your strategy will certainly spend for dentures. In some strategies, dental implants may remain in their own course. If you expect to need dental implants, buy a dental plan that specifically includes coverage for oral implants.

Vision And Dental Insurance For Seniors Laguna Beach, CA

Shop for dental strategies that help cover these kinds of major restorative treatment, so you do not have to pay the whole expense on your very own. Standalone dental plans from an exclusive insurance provider or an oral discount plan can cover more than just preventative treatment If you select to go shopping for a standalone dental plan, look for insurance coverage that includes "significant corrective" benefits.

Plus, recognize what you'll pay before you most likely to the dental expert. Needs change? Your strategy can also. Offer us a phone call and we'll make sure you always have the ideal prepare for your upcoming care. * Discount Health and wellness Program consumer and company surveys show average cost savings of 50%. Financial savings might vary by service provider, area, and plan.

It can also aid stop small issues from becoming large problems by motivating normal dental wellness brows through and check-ups, since plans usually lower or perhaps eliminate the cost of these preventive brows through. Good oral insurance coverage might also provide even more predictability in prices for those residing on a fixed earnings. Standard Medicare (Part A and Part B) does not cover dental treatment in most situations. Medicare Insurance Agent Near Me Laguna Beach.

Best Senior Insurance Laguna Beach, CA

Frequently the only times that dental treatments might be covered by Medicare are when therapy is regarded needed to proceed with a common medical requirement. If you're being treated for oral cancer cells (which would fall under common medical care), a tooth removal to promote treatment might be covered by Medicare.

Nevertheless, actual insurance coverage details differ commonly from strategy to strategy. Numerous Medicare Advantage strategies have extremely minimal dental benefits and regardless, it's approximated that around 65% of Medicare beneficiaries had no dental protection. 4 Generally speaking, there are two main kinds of oral insurance coverage available for seniors who are no longer qualified for oral advantages via work: If you are 65 or older, you might be eligible to enlist in a Medicare Advantage strategy that provides some dental care advantages.

Medicare Insurance Agent Near Me Laguna Beach, CA

Discover more concerning the various sorts of Medicare Advantage plans here. Specific oral plans for elders are available from a variety of exclusive oral insurer. Oral plans often tend to concentrate on making precautionary treatment a lot more budget friendly: The majority of plans cover 100% of preventative treatment expenses, according to the National Association of Dental Plans.

PPOs have a tendency to have a a great deal of dental professionals "in network," but plans differ, so inspect to see if a neighboring carrier you such as remains in the network prior to registering. These network suppliers have pre-negotiated rate price cuts, with the insurance coverage company that can assist you reduce all your dental care.

, yet there's likewise less versatility with a minimal network of providers. 8 Like HMO wellness care plans, members pick a Primary Dental expert and have to go through that service provider for all their treatment, consisting of specialist recommendations.

It is very important to recognize the information of any strategies you are taking into consideration. A private oral insurance strategy will certainly cover routine oral treatment examinations, cleanings, and frequently x-rays at little or no expense to the plan owner. 9Depending on the specific strategy, oral insurance policy can additionally cover much more substantial dental work like straightforward extractions and tooth cavity dental fillings or perhaps major procedures like crowns and bridges

Medicare Providers Near Me Laguna Beach, CA

Strategy deductible: Numerous plans have a deductible. This is the quantity you require to pay before the dental strategy begins paying. Fortunately is that normal preventative sees usually aren't subject to the insurance deductible, and as soon as you've met the insurance deductible for any kind of various other care, you won't pay it again until it resets the following year.

In some cases, it's a percentage of the fee: some plans cover major care at 50% definition 50% of the prices will certainly be your responsibility. Remember: when you see a network PPO dental practitioner, that cost may have already been discounted by regarding 30%, so at the end of the day, your out-of-pocket expense may only be 35% of the full "checklist" rate.

Dental Insurance Seniors Laguna Beach, CA

This is the most that the plan will pay in a provided year $2,000. If your treatment surpasses this optimum, the staying expense might be your responsibility.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

With 6.67/ 10 factors, MetLife rates in third place. It is the only company with an A+ score from AM Finest, making it second just to Guardian (A++). It is 3rd best in the Ton of money 500 scores with a ranking of 46. Established in 1868, this business is the fourth oldest business we reviewed.

Best Dental Insurance For Seniors Laguna Beach, CAMedicare Dental Insurance For Seniors Laguna Beach, CA

Inexpensive Dental Insurance For Seniors Laguna Beach, CA

Vision Insurance For Seniors Laguna Beach, CA

Finding A Seo Expert Laguna Beach, CA

Finding A Local Seo Optimization Laguna Beach, CA

Medicare Insurance Agent Near Me Laguna Beach, CA

Harmony SoCal Insurance Services

Table of Contents

- – Medicare Providers Near Me Laguna Beach, CA

- – Harmony SoCal Insurance Services

- – Senior Health Insurance Laguna Beach, CA

- – Seniors Insurance Laguna Beach, CA

- – Senior Dental Insurance Laguna Beach, CA

- – Reasonable Dental Insurance For Seniors Lagun...

- – Best Dental Insurance For Seniors Laguna Bea...

- – Best Senior Insurance Laguna Beach, CA

- – Dental Insurance For Seniors Laguna Beach, CA

- – Best Insurance For Seniors Laguna Beach, CA

- – Vision And Dental Insurance For Seniors Lagu...

- – Best Senior Insurance Laguna Beach, CA

- – Medicare Insurance Agent Near Me Laguna Beac...

- – Medicare Providers Near Me Laguna Beach, CA

- – Dental Insurance Seniors Laguna Beach, CA

- – Harmony SoCal Insurance Services

Latest Posts

Concrete Patio Contractor Dublin

Patio Contractor Near Me Clayton

Patio Contractor Near Me San Leandro

More

Latest Posts

Concrete Patio Contractor Dublin

Patio Contractor Near Me Clayton

Patio Contractor Near Me San Leandro