All Categories

Featured

Table of Contents

- – Best Insurance For Seniors Yorba Linda, CA

- – Harmony SoCal Insurance Services

- – Dental Insurance Seniors Yorba Linda, CA

- – Senior Dental Insurance Yorba Linda, CA

- – Best Dental Insurance Seniors Yorba Linda, CA

- – Medicare Insurance Agent Near Me Yorba Linda, CA

- – Dental Insurance For Seniors With No Waiting...

- – Best Partd Insurance Company For Seniors Yor...

- – Medicare Insurance Agent Near Me Yorba Linda...

- – Low Cost Dental Services For Seniors Without...

- – Health Insurance For Seniors Yorba Linda, CA

- – Best Senior Insurance Yorba Linda, CA

- – Best Partd Insurance Company For Seniors Yor...

- – Reasonable Dental Insurance For Seniors Yorb...

- – Best Senior Insurance Yorba Linda, CA

- – Harmony SoCal Insurance Services

Best Insurance For Seniors Yorba Linda, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Actual coverage details differ commonly from strategy to strategy. 4 Generally speaking, there are two main kinds of dental insurance coverage available for senior citizens that are no much longer qualified for dental benefits via job: If you are 65 or older, you may be eligible to register in a Medicare Advantage strategy that offers some dental care benefits.

Find out more about the various sorts of Medicare Benefit plans below. Private oral prepare for senior citizens are available from a selection of personal dental insurance provider. Oral plans tend to concentrate on making precautionary care more budget-friendly: A lot of strategies cover 100% of preventative care prices, according to the National Association of Dental Program.

Dental Insurance Seniors Yorba Linda, CA

PPOs often tend to have a multitude of dental practitioners "in network," yet strategies vary, so check to see if a neighboring company you such as is in the network prior to subscribing. These network service providers have pre-negotiated price discounts, with the insurance coverage company that can aid you minimize all your dental treatment.

, however there's also much less versatility with a restricted network of service providers. 8 Like HMO health care strategies, members select a Primary Dental expert and have to go via that company for all their care, including professional references.

It's crucial to comprehend the details of any kind of plans you are thinking about. In many cases, a specific oral insurance coverage strategy will cover regular oral care check-ups, cleanings, and commonly x-rays at little or no charge to the plan owner. 9Depending on the certain strategy, oral insurance coverage can additionally cover much more considerable oral work like basic removals and tooth cavity fillings or perhaps major procedures like crowns and bridges.

Senior Dental Insurance Yorba Linda, CA

Plan insurance deductible: Lots of plans have a deductible. This is the amount you require to pay before the dental strategy starts paying. Fortunately is that normal preventive visits generally aren't subject to the deductible, and once you've satisfied the deductible for any other treatment, you won't pay it once more till it resets the following year.

Occasionally, it's a percent of the charge: some strategies cover significant treatment at 50% significance 50% of the costs will be your responsibility. Yet remember: when you see a network PPO dental professional, that cost may have currently been discounted by about 30%, so at the end of the day, your out-of-pocket cost might only be 35% of the full "listing" cost.

Locating the finest Medicare Benefit plan for your needs needs carefully considering your spending plan, healthcare needs, and the plans offered in your location. Not all Medicare Advantage prepares deal senior citizens dental insurance protection.

Comprehending how oral insurance coverage for elders works can help you make best use of benefits and avoid unanticipated expenses. A set monthly price maintains your plan energetic. Predictable settlements for comfort. Examinations, cleansings, and x-rays are typically covered 100%. Quits little concerns from becoming large expenses. Dental fillings, crowns, or dentures are partially covered.

Best Dental Insurance Seniors Yorba Linda, CA

Each plan has a yearly insurance coverage limit. Ensures the biggest savings on every browse through. Use within 30 days of retirement to make certain continuous protection and miss any waiting durations for your brand-new oral plan.

Best for senior citizens that just need precautionary solutions. Balanced strategy covering precautionary treatment plus restorative solutions like bridges and crowns. Suitable for elders who want comprehensive coverage at a moderate costs. Enhanced insurance coverage with a higher annual advantage maximum and lower out-of-pocket costs. Best for seniors anticipating major oral work or requiring substantial services like dentures or implants.

Medicare Insurance Agent Near Me Yorba Linda, CA

Protection for procedures to treat innovative dental issues. If you wear dentures, fixings are covered under some plans. Delta Dental supplies versatile strategies, including alternatives for senior citizens with varying requirements, whether you're looking for standard care or even more substantial dental job. To choose the appropriate oral plan for elders, take into consideration: If you remain in great dental health and simply require regular care, a strategy like Preventive Prime might suffice.

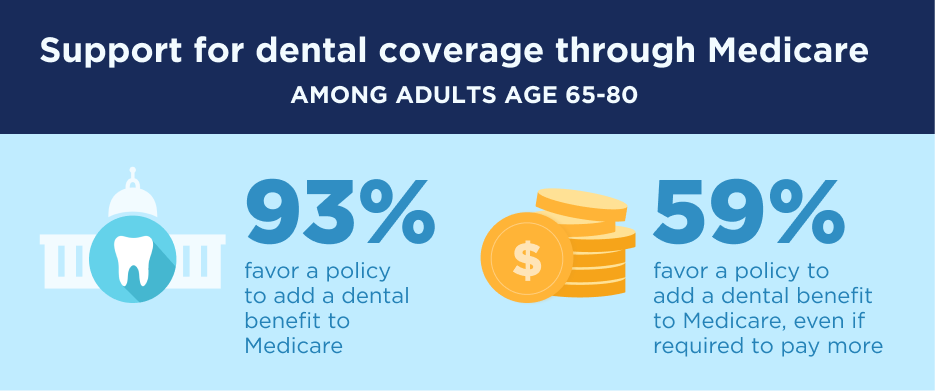

Right here are some means to discover the best oral insurance coverage for elders on Medicare. Original Medicare does not cover dental wellness so you'll intend to take into consideration alternatives for oral insurance coverage. Here are some suggestions to aid; Think of what dental solution you need? Do you need dentures or implants? Are your teeth in relatively good or bad form? Take into consideration Medicare Benefit intends with oral advantages.

Review plan coverage very carefully. Read all restrictions. Call firms advertising their products. Obtain a consultation from a neighborhood insurance policy expert. Elders on Medicare have several alternatives for oral protection. Two in three senior citizens 65 and older have gum condition according to the Centers for Disease Control and Avoidance (CDC).

Gum tissue condition raises the danger of heart illness. Older grownups with inadequate dental hygiene that smoke are at increased risk of microbial pneumonia. They likewise face raised danger of dental cancers. While rare, some 54,000 situations or oral cancer are anticipated to be diagnosed in the United States this year.

Dental Insurance For Seniors With No Waiting Period Yorba Linda, CA

Those that offer Medicare Supplement (Medigap) extremely frequently likewise offer senior dental plans. Oral insurance coverage within these strategies is frequently consisted of (free).

It is complimentary and entirely exclusive. Simply enter your postal code. Click the web link to access the. Many people just concentrate on the medical or health-related aspects of Medicare when they transform 65. That is easy to understand due to the fact that choosing what's the most effective health-plan alternative can be perplexing enough. Yet, oral is an important part and needs to at the very least be weighed as an aspect when comparing alternatives.

And, these strategies typically market the fact that they include cost-free added advantages. Oral is commonly stated as one of the included advantages. What strategies cover and what limitations exist can differ.

Check very carefully to see if your dental expert is coverage by a certain dental strategy you are taking into consideration. He or she likely knows better than any individual what dental insurance coverage for senior citizens strategies are best.

Best Partd Insurance Company For Seniors Yorba Linda, CA

The terms insurance representative and insurance coverage broker appear to imply the same thing. That's not real. A representative generally represents just one insurance provider. A broker typically is independent and represents several insurance policy firms. Is one better than the other? No. At the very least understand why they may be advising a particular insurance strategy.

There are advantages and disadvantages for every plan. Some insurer supply multiple plans to compare. It pays to function with someone who can aid you contrast plans from these companies: Aetna Aflac Cigna Delta Dental Humana Renaissance Dental United Health Care Locate Newest Discover Discover more concerning alternatives.

Medicare Insurance Agent Near Me Yorba Linda, CA

The firm uses two dental plans, Common Dental Defense and Common Dental Preferred, along with a vision cyclist and a dental financial savings plan. The least costly dental plan begins at an estimated $29.27 monthly, although expenses will certainly differ by location. You can pick from annual optimum advantages of as much as $5,000 to customize the protection to your requirements.

Costs and motorcyclist prices vary, however, and plans are not readily available in all 50 states. We researched plan quotes for Miami, Florida. The Mutual Dental Protection plan costs about $29.27 per month with a $100 calendar year deductible. It covers preventative solutions in complete, 50% of standard solutions, and 20% of major solutions on day one (50% of significant services after year one).

The Mutual Dental Preferred plan costs concerning $56.38 monthly. It has no insurance deductible for preventive solutions, but there's a $50 deductible for standard and significant solutions. Its precautionary and significant services insurance coverage coincides as the Defense strategy, but the Preferred strategy covers 80% of standard services compared to the Security plan's 50%.

Low Cost Dental Services For Seniors Without Insurance Yorba Linda, CA

You might have escaped regular dental examinations and cleanings in your more youthful years. Older adults' teeth may call for more intricate therapy. An oral strategy that only covers you for preventative treatment will not assist you pay for a lot more pricey oral procedures and treatments if you need them.

Discover out what levels of oral protection you may require. In the oral plan files, they may be called "classes" of insurance coverage.

As soon as you satisfy your dental deductible, that percent shows just how much of the cost your plan will certainly pay for these treatments. Look for these particular treatments in the plan papers.

Store for an oral strategy that offers a portion of protection. If you expect to require dental implants, shop for a dental strategy that specifically consists of insurance coverage for oral implants.

Health Insurance For Seniors Yorba Linda, CA

Will you need an origin canal, bridge, or implants? Do you need dentures? Look for dental strategies that help cover these kinds of significant corrective treatment, so you don't need to pay the entire expense by yourself. Standalone dental strategies from a private insurer or an oral discount rate plan can cover greater than simply precautionary treatment If you choose to buy a standalone oral plan, search for insurance coverage that includes "significant corrective" advantages.

Your plan can too. Give us a call and we'll make sure you always have the ideal plan for your upcoming treatment. Financial savings might differ by supplier, area, and strategy.

It can additionally assist protect against little troubles from coming to be huge problems by encouraging regular oral wellness visits and checkups, due to the fact that strategies generally reduced or also get rid of the price of these preventative gos to. Good oral insurance coverage might additionally give more predictability in prices for those living on a fixed revenue.

Best Senior Insurance Yorba Linda, CA

Usually the only times that dental procedures may be covered by Medicare are when therapy is deemed needed to proceed with a basic medical demand. If you're being dealt with for oral cancer (which would fall under conventional clinical care), a tooth extraction to facilitate treatment could be covered by Medicare.

Actual coverage details differ widely from plan to plan. 4 Broadly talking, there are 2 major kinds of dental protection available for elders who are no much longer eligible for dental advantages via work: If you are 65 or older, you may be eligible to enroll in a Medicare Advantage plan that uses some oral care advantages.

Best Partd Insurance Company For Seniors Yorba Linda, CA

Discover more concerning the various kinds of Medicare Benefit intends here. Private dental plans for senior citizens are offered from a selection of private dental insurer. Dental strategies have a tendency to concentrate on making precautionary treatment a lot more economical: A lot of strategies cover 100% of preventative care costs, according to the National Association of Dental Plans.

PPOs tend to have a a great deal of dentists "in network," however strategies vary, so inspect to see if a neighboring service provider you such as remains in the network prior to subscribing. These network carriers have pre-negotiated price discount rates, with the insurer that can help you minimize all your oral treatment.

These dental strategies often tend to provide reduced costs and deductibles, but there's likewise less adaptability with a minimal network of service providers. 8 Like HMO healthcare strategies, members pick a Key Dental expert and have to go via that supplier for all their care, consisting of professional references. Many DHMO dental plans have no deductibles or caps and while there might be a flat-rate copayment for non-preventive treatments, your overall expenses will likely be lower.

It is necessary to comprehend the information of any type of plans you are considering. An individual dental insurance strategy will certainly cover routine dental care check-ups, cleanings, and typically x-rays at little or no price to the strategy owner. 9Depending on the details plan, oral insurance coverage can also cover more considerable dental work like straightforward extractions and dental caries fillings or even significant treatments like crowns and bridges

Reasonable Dental Insurance For Seniors Yorba Linda, CA

Strategy insurance deductible: Lots of plans have a deductible. This is the quantity you require to pay before the oral plan begins paying. Fortunately is that normal preventive brows through commonly aren't based on the insurance deductible, and when you've satisfied the deductible for any kind of other care, you will not pay it once more up until it resets the list below year.

Occasionally, it's a portion of the charge: some plans cover significant care at 50% definition 50% of the prices will certainly be your responsibility. Remember: when you see a network PPO dental expert, that charge may have currently been discounted by regarding 30%, so at the end of the day, your out-of-pocket price may only be 35% of the complete "list" price.

Best Senior Insurance Yorba Linda, CA

This is the most that the plan will pay in a given year $2,000. If your care exceeds this optimum, the remaining expense may be your responsibility.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

With 6.67/ 10 factors, MetLife rates in 3rd location. It is the only business with an A+ rating from AM Ideal, making it second only to Guardian (A++). It is third ideal in the Lot of money 500 ratings with a position of 46. Established in 1868, this business is the fourth oldest company we reviewed.

Delta Dental Insurance For Seniors Yorba Linda, CABest Dental Insurance Seniors Yorba Linda, CA

Dental Insurance For Seniors Yorba Linda, CA

Hearing Insurance For Seniors Yorba Linda, CA

Local Seo Consultant Yorba Linda, CA

Near You Seo Companies Yorba Linda, CA

Hearing Insurance For Seniors Yorba Linda, CA

Harmony SoCal Insurance Services

Table of Contents

- – Best Insurance For Seniors Yorba Linda, CA

- – Harmony SoCal Insurance Services

- – Dental Insurance Seniors Yorba Linda, CA

- – Senior Dental Insurance Yorba Linda, CA

- – Best Dental Insurance Seniors Yorba Linda, CA

- – Medicare Insurance Agent Near Me Yorba Linda, CA

- – Dental Insurance For Seniors With No Waiting...

- – Best Partd Insurance Company For Seniors Yor...

- – Medicare Insurance Agent Near Me Yorba Linda...

- – Low Cost Dental Services For Seniors Without...

- – Health Insurance For Seniors Yorba Linda, CA

- – Best Senior Insurance Yorba Linda, CA

- – Best Partd Insurance Company For Seniors Yor...

- – Reasonable Dental Insurance For Seniors Yorb...

- – Best Senior Insurance Yorba Linda, CA

- – Harmony SoCal Insurance Services

Latest Posts

Orange County Family Photographers Irvine

Redlands Photographer Family Portraits

Graduation Pictures Photographers Near Me Pomona

More

Latest Posts

Orange County Family Photographers Irvine

Redlands Photographer Family Portraits

Graduation Pictures Photographers Near Me Pomona